Chinese regulators suggested Didi delay its US IPO: WSJ

NEW YORK: China’s cybersecurity watchdog suggested Didi Global Inc delay its initial public offering and urged it to review its network security, weeks before the Chinese ride-hailing giant went public, the Wall Street Journal reported on Monday, citing people familiar with the matter.

It isn’t known whether Didi carried out its own review, according to the WSJ report. But a person close to the company told the newspaper the company ultimately decided to go ahead with the IPO as it faced increasing investor pressure for a big payout.

The Cyberspace Administration of China (CAC) launched the investigation into Didi on Friday, just two days after the company began trading on the New York Stock Exchange.

On Sunday, the agency ordered a suspension of app downloads for Didi after it found the company illegally collected personal user data.

Didi said in a statement on Monday it had no knowledge before its US$4.4 billion listing that CAC would start to investigate the company and order its app to be taken down.

Officials in Beijing, especially those at CAC, were wary of the ride-hailing giant’s troves of data potentially falling into foreign hands as a result of the greater public disclosure associated with a US listing, according to the WSJ report.

Chinese internet regulators have tightened rules for the country’s tech giants in recent years, asking companies to collect, store and handle key data properly.

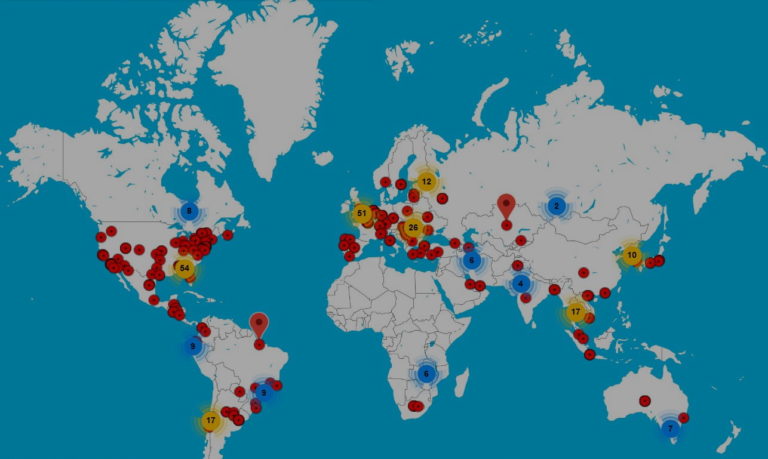

Didi, which offers services in China and more than 15 other markets, gathers vast amounts of real-time mobility data every day.