Covid pandemic fuelling financial crime, says UAE Central Bank

Follow the latest updates on the Covid-19 pandemic here

The Covid-19 pandemic, which shook financial markets and trigged economic chaos last year, has heightened the risk of money laundering and terrorist financing, fraud, cyber attacks, bribery and corruption across the financial system, according to the Central Bank of the UAE.

The use of e-commerce services and virtual currencies for money laundering; corporate fraud schemes, a surge in unlicensed money-service providers, and charity and disaster-related scams are some of the trends that have emerged during the pandemic, the regulator said in Typologies in the Financial Sector, a report released on Sunday.

The banking regulator selected several financial institutions to observe certain activities in the market and asked them to actively engage with the authorities.

The risks derived from the typologies identified are in addition to the risks of crimes related to money laundering and terrorist financing. These have already been outlined in the UAE’s National Risk Assessment and are “likely to be prevalent across the wider financial sector”, the Central Bank said in a separate statement.

“This report is part of our ongoing efforts to address money laundering and terrorist financing-specific trends and typologies emerging from the Covid-19 pandemic in the financial sector,” said Central Bank Governor, Khaled Balama.

“Although these risks are still in the early stages of identification, the CBUAE, alongside the concerned supervisory authorities, have released this report as key reference on pandemic-related typologies and indicators to the financial institutions, so they remain abreast of and be able to mitigate these emerging risks, which ultimately contribute to safeguarding the integrity of the UAE financial system.”

The report on pandemic typologies was prepared by the Supervisory Authorities Sub-Committee, which is chaired by the Central Bank and includes Abu Dhabi Global Market, the Dubai Financial Services Authority, the Executive Office for Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT), and the UAE Financial Intelligence Unit (FIU).

The UAE has introduced strict measures to combat money laundering and set up a dedicated agency this year to identify people responsible and those suspected of financing terrorists and organised crime. The Central Bank also regularly issues guidelines on how financial institutions can assess money-laundering risks.

In July, the banking regulator issued guidelines governing the implementation of sanctions related to AML/CFT. In August, it issued instructions to registered hawala providers in the UAE and financial institutions providing services to them.

Earlier this month, the Central Bank asked financial institutions, including lenders, to develop internal policies, controls and procedures to manage risks linked to money laundering.

The typology report will help financial institutions in identifying Covid-related risks and implement effective mitigation methods to keep the financial system healthy, the Central Bank said.

Among the risks identified by the report is a likely increase in the use of professional money-laundering services. These use a variety of methods, including those that do not require the physical movement of cash or goods.

“Criminals who have previously relied on self-executed money laundering schemes may now be seeking the help of PMLs,” the report said.

The widespread lockdowns resulted in a significant surge in e-commerce. Because of people’s limited ability to move funds and goods during the pandemic, “illicit actors are turning to e-commerce as a money-laundering tool”, the report said.

Criminals can use fake digital storefronts that look like legitimate merchants. They may also use “pass-through companies” or “transaction laundering” – illicit businesses using a legitimate merchant’s platform to process illicit payments.

“This is referred to as ‘money laundering of the digital age’, which is extremely difficult for financial institutions to detect,” the report added.

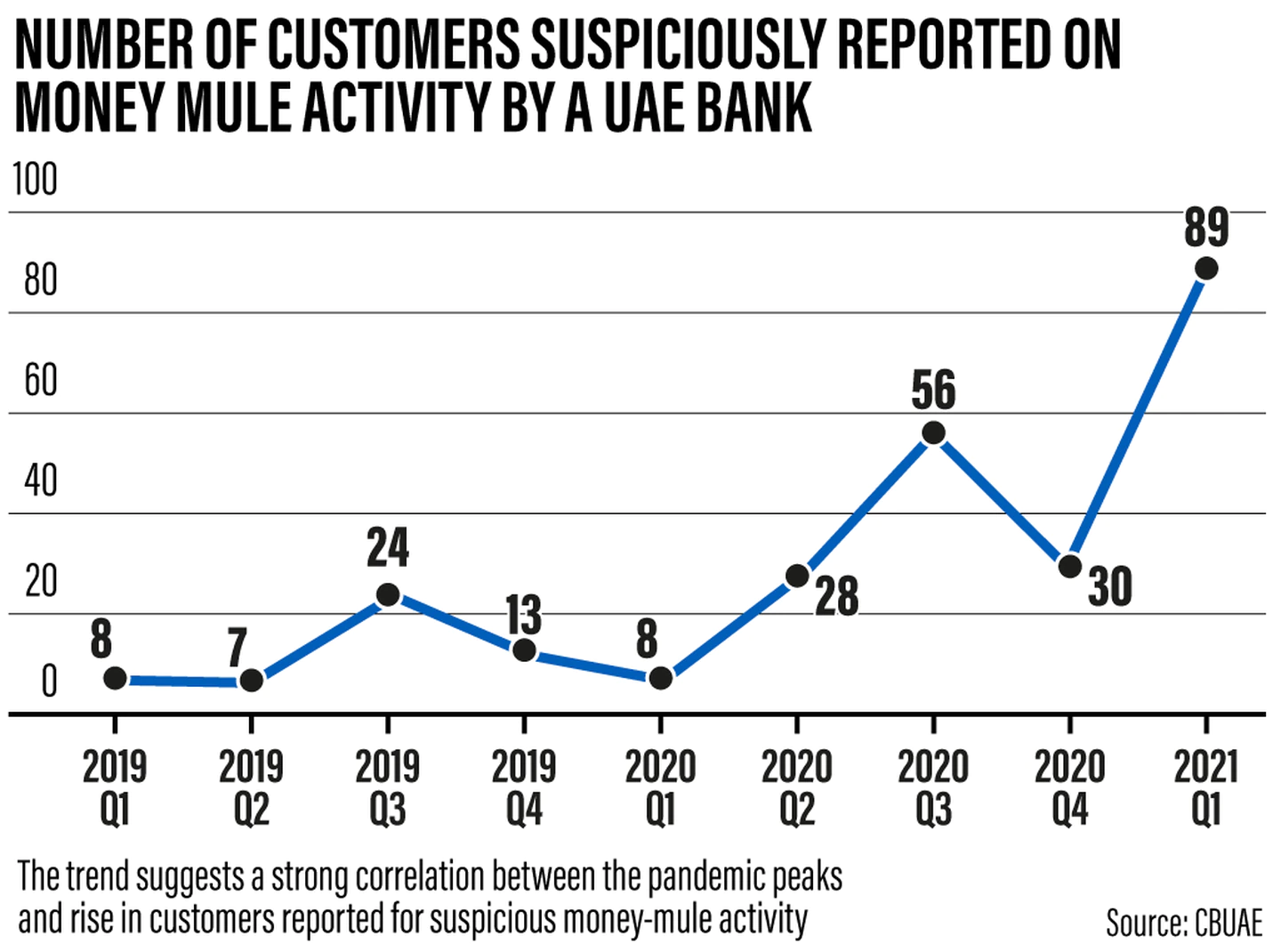

The Central Bank said that the number of “money-mules” used to launder ill-gotten funds also increased, which is a direct result of financial distress.

The use of virtual currencies may also be intensifying during the Covid-19 pandemic, as criminals earning virtual currencies illegally would ultimately look for ways to convert third-party proceeds into cash or other assets.

Other Covid-related risks include increased and unexplained cross-border fund flows to high-risk jurisdictions, terrorist organisations looking to raise funds under the guise of Covid-related relief activities, online exploitation of impoverished or financially distressed communities, and forced labour.

This report is part of our ongoing efforts to address money laundering and terrorist financing-specific trends and typologies emerging from the Covid-19 pandemic in the financial sector

Khaled Balama, Governor, CBUAE

“Citizenship by Investment schemes offered by countries located in the Caribbean region pose potential financial-crime risks to the financial sectors in the UAE,” the report said.

“Although CBI schemes may be pursued for legitimate purposes, in particular visa-free access to the EU, the UK and other countries, CBI schemes pose corruption, sanction, money laundering and tax-evasion risks.”

The growing reliance on technology and remote working models have also exposed digital vulnerabilities, because phishing attacks, hacking, malware intrusions and fraud stemming from potential information breaches containing personal data, are on the rise.

“This is an important factor to address where documents containing confidential customer and/or financial information are shared between staff via a distributed work environment,” the report said.

“Organisations should prepare for possible business disruption and proactively assess their cyber-hygiene practices followed by their remote workforce, enterprise-wide.”

Updated: September 20th 2021, 4:25 AM